Case Study #1

Repossession case prevented from proceeding via the putting in place of a Personal Insolvency Arrangement – PIA.

Example 1 PIA

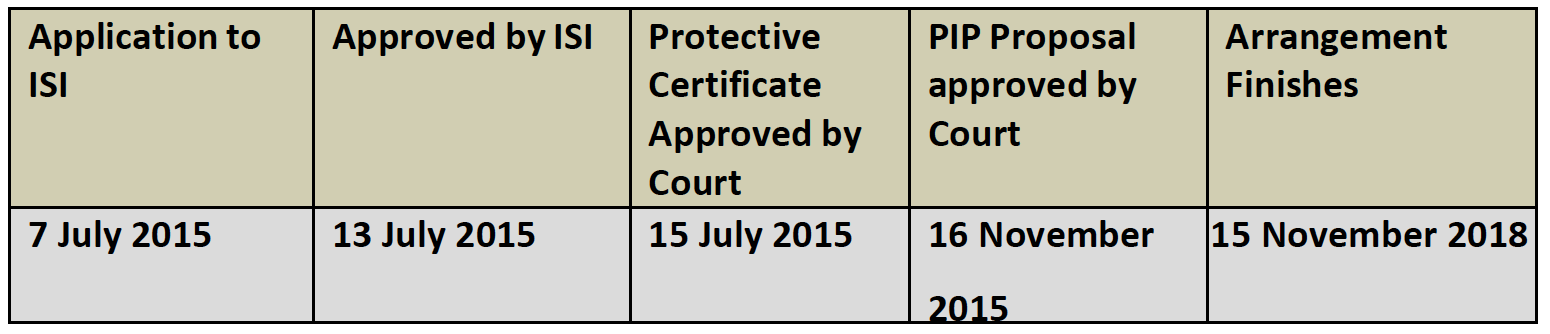

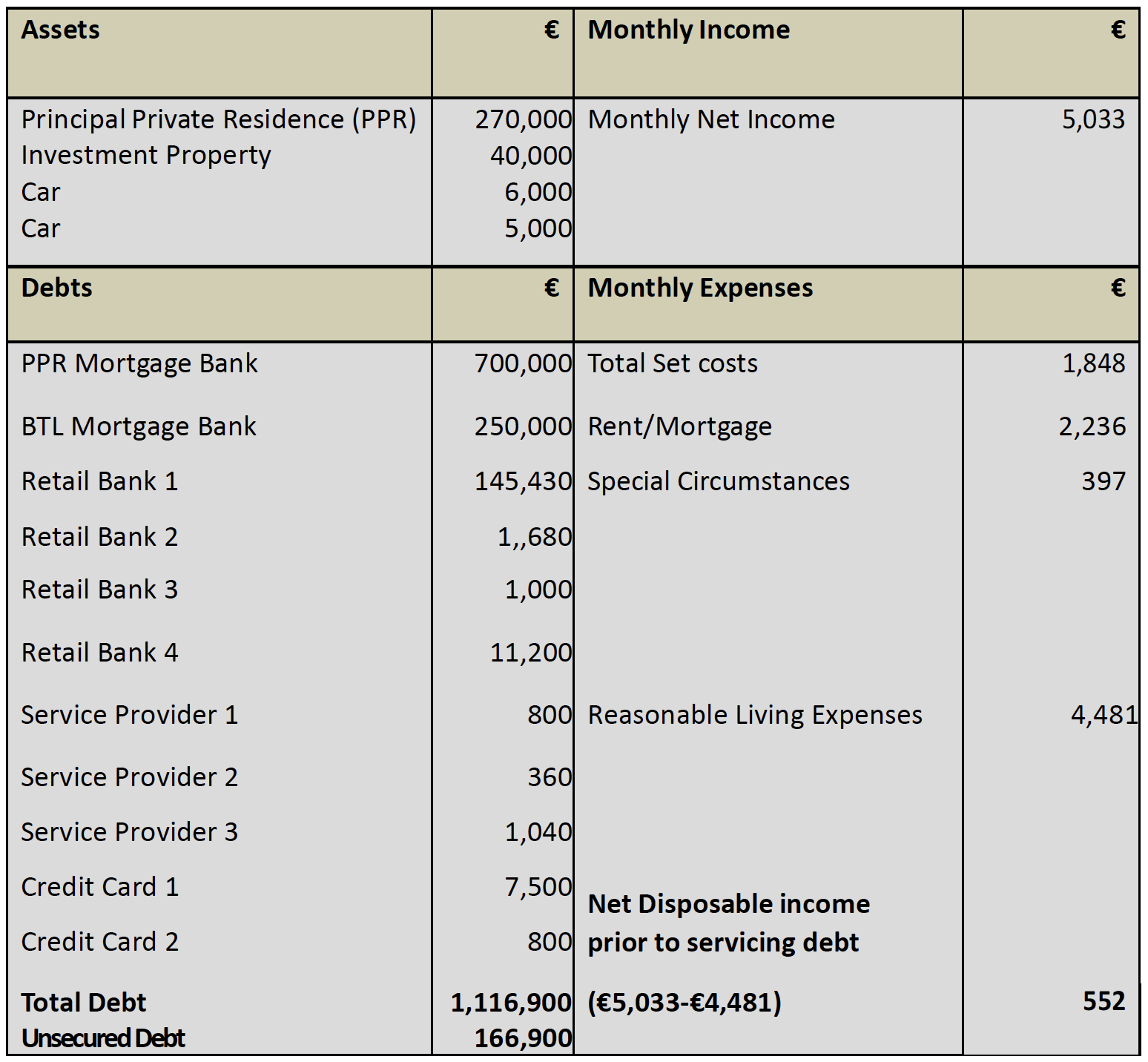

This is a case of an interlocking PIA with imminent repossession avoided for two debtors who are married. They both lost their jobs in 2008. The husband is now self-employed with the wife working at home looking after the children. They have two children in primary school. They have a family home worth €270,000 (in €400,000 negative equity), a residential investment property in significant negative equity (€215,000) and repossession proceedings had commenced in Court.

The debtors were granted an adjournment to their family home repossession hearing to explore a PIA.

The Personal Insolvency Practitioner established that a lack of disposable income meant a regular dividend solution was not feasible. The PIP identified a possible long term sustainable mortgage restructure.

The debtor sourced a €20,000 contribution from relatives. A one month (lump sum) PIA was proposed. Creditors agreed to a three-year PIA with a lump sum at commencement with three annual reviews to be undertaken by the PIP.

50% of the family home mortgage was restructured to a level sustainable for the borrowers with the other 50% warehoused at 0% until the death of the longest surviving spouse.

The negative equity on the investment property was written off and the property returned to the Bank. The majority of the unsecured debt was written off (circa 2% return).