Case Study #2

Repossession case prevented from proceeding via the putting in place of a Personal Insolvency Arrangement – PIA.

Example 2 PIA

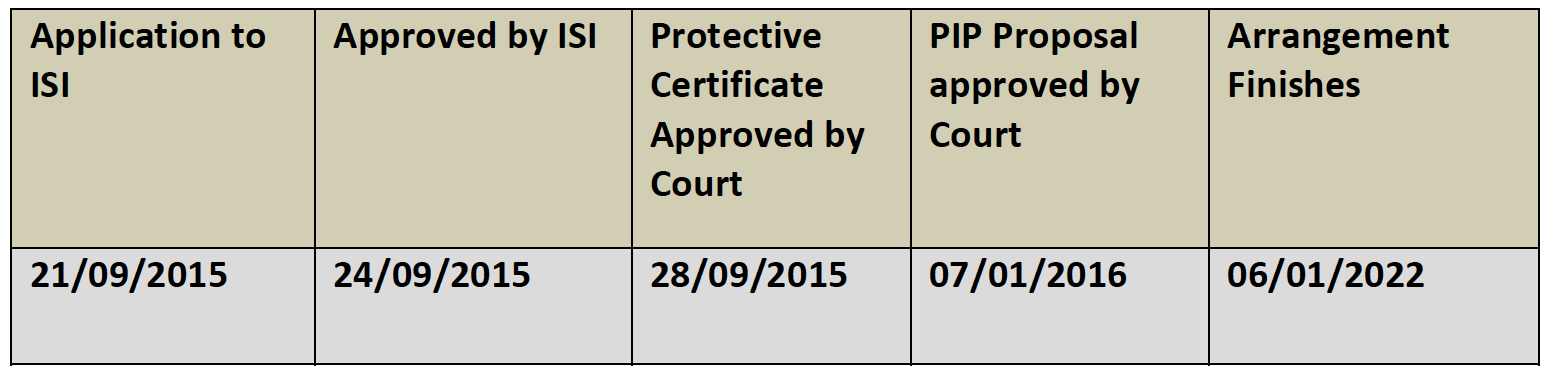

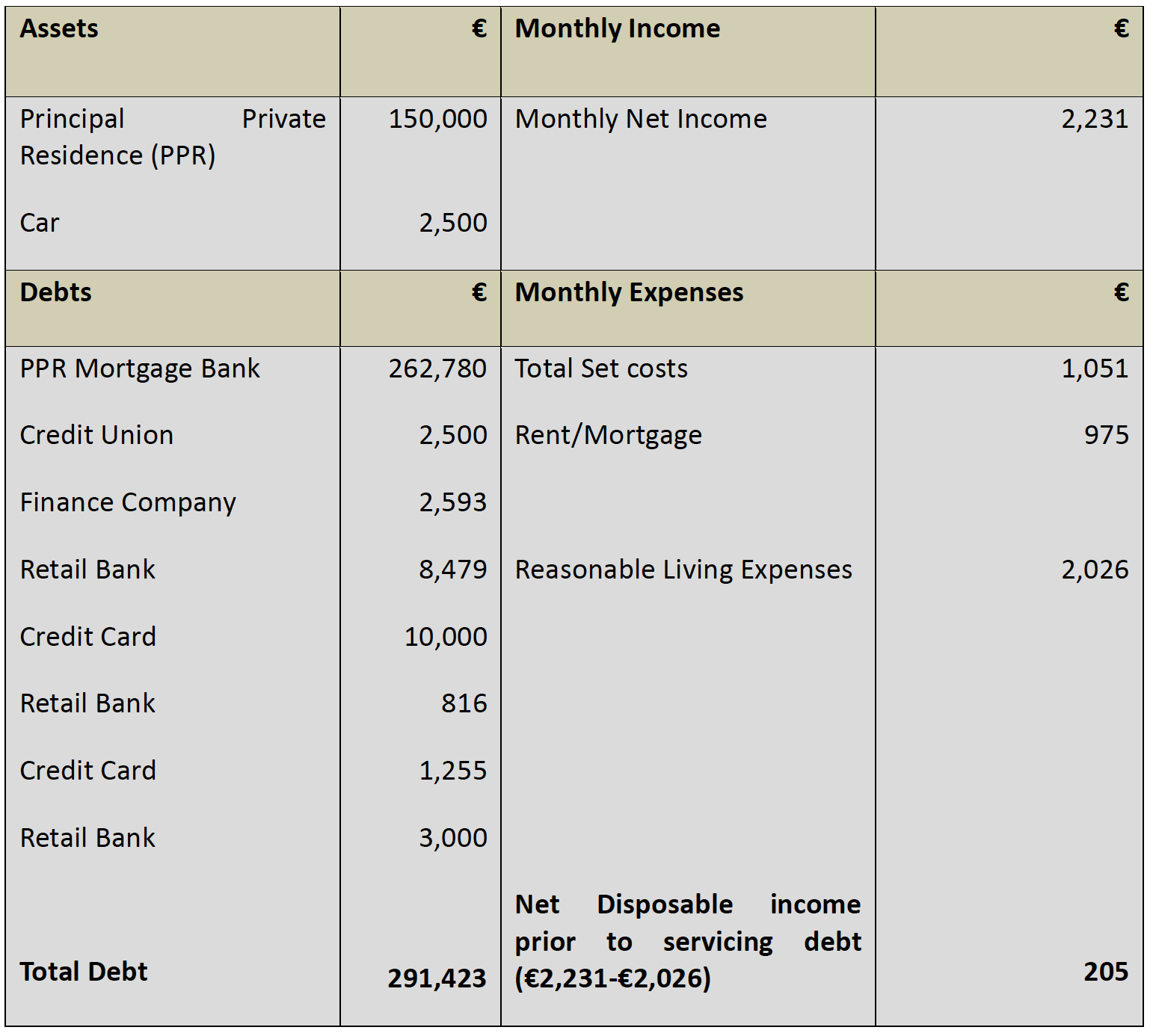

This is an example of a single female, aged 51, in employment, with a car. In this case the individual had a principal private residence in significant negative equity and was subject to repossession proceedings. She had fallen into arrears on her mortgage repayments. Despite being in employment, the individual was living below what the ISI deem to be reasonable.

The debtor was granted an adjournment to their home repossession hearing to explore a PIA.

The Personal Insolvency Practitioner was able to implement a split mortgage solution within the PIA which also dealt with unsecured creditors.

The PIA will be for the full duration of 6 years. €130,000 of the PPR debt will be warehoused at 0% for the debtors lifetime. Her mortgage term will be extended for 5 years to allow her mortgage repayments be to reduced to a sustainable level.

The unsecured creditors will share in a dividend of 13% during the PIA.